The Latest Updates on EU VAT Rules and IOSS for E-Commerce

Recently, the European Union (EU) has implemented new VAT rules and introduced the Import One-Stop Shop (IOSS) policy for e-commerce transactions.

What is the Import One-Stop Shop (IOSS)?

- The IOSS is an electronic platform mandated for businesses since July 1, 2021, to fulfill their VAT obligations for distance sales of imported goods.

- Previously, goods valued up to EUR 22 were exempt from VAT when imported into the EU for commercial purposes. However, with the new regulations, this exemption has been removed, and all commercial goods from non-EU countries are now subject to VAT.

- A special scheme has been introduced for B2C goods imported from non-EU countries with a value not exceeding EUR 150. This IOSS scheme allows VAT to be collected at the point of purchase, simplifying the process for customers.

Customs Duties and VAT Thresholds

Customs duties are waived for goods valued under EUR 150 when imported into the EU member states, while goods exceeding this value will follow standard customs procedures.

Adapting to the VAT Reform

- Wellcircuits will register for the IOSS VAT ID and collect VAT on B2C orders below EUR 150 during checkout.

- We will declare and remit VAT to EU tax authorities monthly to ensure compliance.

- B2B customers must provide their VAT number for orders placed after July 1, 2021.

Explore more about EU VAT E-Commerce and IOSS here and IOSS Information.

Wellcircuits’ Response to the VAT Reform

Our IOSS payment method (DHL DDP) will be launched soon to streamline the process. In the meantime, you can utilize our current shipping options.

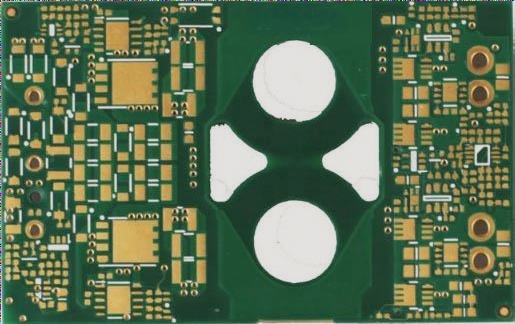

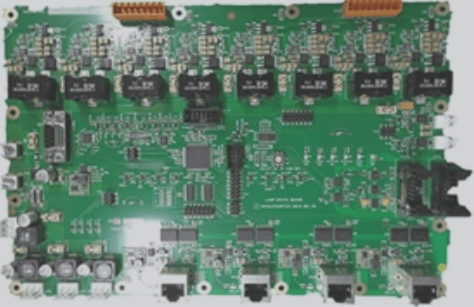

If you have any inquiries regarding PCBs or PCBA, contact us at info@wellcircuits.com.