Key Takeaways

- PCBA boards primarily fall under HTS code 8542.31.00 for electronic integrated circuits and microassemblies, while bare PCBs use 8534.00.00

- Correct HTS classification depends on the board’s function, components, and end-use application rather than just physical characteristics

- Misclassification can result in customs penalties up to 20% of shipment value, delays of 7-14 days, and potential legal compliance issues

- The United States uses a 10-digit HTS system while most countries use 6-8 digit HS codes, requiring verification for each destination market

- Professional classification through customs brokers or official ruling requests can prevent costly errors for high-value PCBA shipments

Navigating the complex world of international trade regulations for printed circuit board assemblies requires precise understanding of harmonized system codes. A single misclassification can trigger thousands of dollars in penalties, weeks of customs delays, and serious compliance issues that impact your business operations.

The distinction between a bare printed circuit board and a populated PCBA fundamentally changes how customs authorities classify your product. While this might seem like a minor technical detail, it directly affects your duty costs, customs clearance timelines, and legal compliance obligations across global markets.

This comprehensive guide provides the practical framework needed to accurately classify PCBA products, avoid costly delays, and ensure compliance with international trade regulations. From understanding basic HS code structure to implementing professional classification procedures, you’ll gain the knowledge necessary to navigate PCBA classification challenges confidently.

Understanding HTS Codes for Printed Circuit Board Assemblies

The harmonized tariff schedule represents a standardized numerical classification system developed by the World Customs Organization to facilitate international trade. This system ensures consistent product classification across nearly all trading nations, creating a foundation for customs duties, trade statistics, and regulatory enforcement. Printed circuit board assemblies are classified under the broader category of electrical machinery and equipment in Chapter 85 of the harmonized system.

In the United States, the HTS code utilizes a 10-digit structure where the first six digits align with the global harmonized system. Countries then add additional digits to create more specific national classifications for tariff and statistical purposes. This standardized approach enables accurate communication between trading partners while supporting precise duty calculations.

For printed circuit board assemblies, classification complexity arises from the need to distinguish between bare printed circuit boards and fully populated assemblies. Customs authorities evaluate not just the physical characteristics, but the functional capabilities, component integration, and intended end-use applications when determining the correct harmonized system code. Businesses can use official databases and resources to find codes for their products, and some countries may have their own codes or country-specific classification systems in addition to the standard HS codes.

The proper classification of PCBA products directly impacts several critical business factors. Duty rates can vary significantly between different HTS classifications, affecting your landed costs and competitive positioning. Customs clearance time depends heavily on accurate classification, as misclassified shipments trigger additional scrutiny and examination procedures. Trade compliance obligations also vary based on specific harmonized system codes, particularly for products subject to export controls or special licensing requirements. Consulting official customs references is essential to ensure compliance and avoid misclassification.

Understanding these fundamental concepts provides the foundation for making informed classification decisions that protect your business from penalties while optimizing your international trade operations.

Primary HTS Codes for PCBA Products

The most commonly used classification for printed circuit board assemblies falls under HTS 8542.31.00, which covers electronic integrated circuits and microassemblies. This is one of the most common HS codes and a key HS code for classifying PCBA products in international trade. This classification applies when the PCBA contains microprocessors, memory chips, or other integrated circuits that provide the primary functional value of the assembly.

Bare printed circuit boards without mounted components typically receive classification under HTS 8534.00.00. This code specifically addresses printed circuits consisting of insulating material with conductive tracks, pads, and vias, but lacking any electronic components. The presence of even basic components like resistors or capacitors generally moves the classification away from this heading. Printed circuit assemblies and loaded PCBAs may require different PCBA HS codes depending on their components and functions.

Industrial control applications often utilize HTS 8537.10.00 for boards designed for electric control or distribution of electricity. These assemblies typically integrate switching devices, relays, and control circuits within panels or enclosures designed for industrial automation or power distribution systems. Control panels are essential assemblies for circuit protection and power distribution in these contexts.

Computing-related PCBAs may qualify for HTS 8473.30.20 when they function as parts and accessories of automatic data processing machines. This classification requires clear documentation that the assembly serves as a dedicated component within computer systems or related equipment. Computer accessories and modules may also fall under related HS codes, depending on their integration and function.

Many countries implement additional digits beyond the basic HS structure to create more specific classifications. The European Union employs variable-length TARIC codes that can extend to 10 or more digits, while Asian markets often use 8-digit systems with country-specific interpretations. Using the right HS code and correct classification is essential for accurate customs code assignment and determining import duties.

Function-Based Classification Categories

Consumer electronics PCBAs encompass a broad range of applications from smartphones and tablets to gaming devices and home appliances. Communication devices such as smartphones and networking equipment are a major category of PCBA applications, each with their own classification considerations. These assemblies typically fall under headings related to their end-use equipment, such as 8517 for telecommunications devices or 8528 for reception apparatus for television.

Industrial control PCBAs serve automation systems, motor controllers, and process control equipment. Circuit protection is a key function of control panels and automation assemblies, ensuring safe and reliable operation. Classification often depends on whether the assembly operates as a standalone control unit or integrates into larger machinery systems. Proper documentation of the control functions and integration methods supports accurate classification.

Telecommunications PCBAs include components for routers, switches, base stations, and network infrastructure equipment. Test devices used in network infrastructure may also require specific classification under different hs codes. These products frequently require careful analysis to distinguish between general electronic assemblies and specialized telecommunications equipment parts, which may qualify for different duty treatments under various trade agreements.

Medical device PCBAs demand particular attention due to potential duty-free treatments available for certain medical equipment classifications. These assemblies often qualify as parts of instruments under Chapter 90 of the harmonized system, potentially offering significant duty savings compared to generic electronic component classifications.

Automotive PCBAs represent a growing segment with specialized classification requirements. Electronic control units, infotainment systems, and safety modules may qualify for automotive-specific tariff treatments, particularly under regional trade agreements that provide preferential access for automotive components.

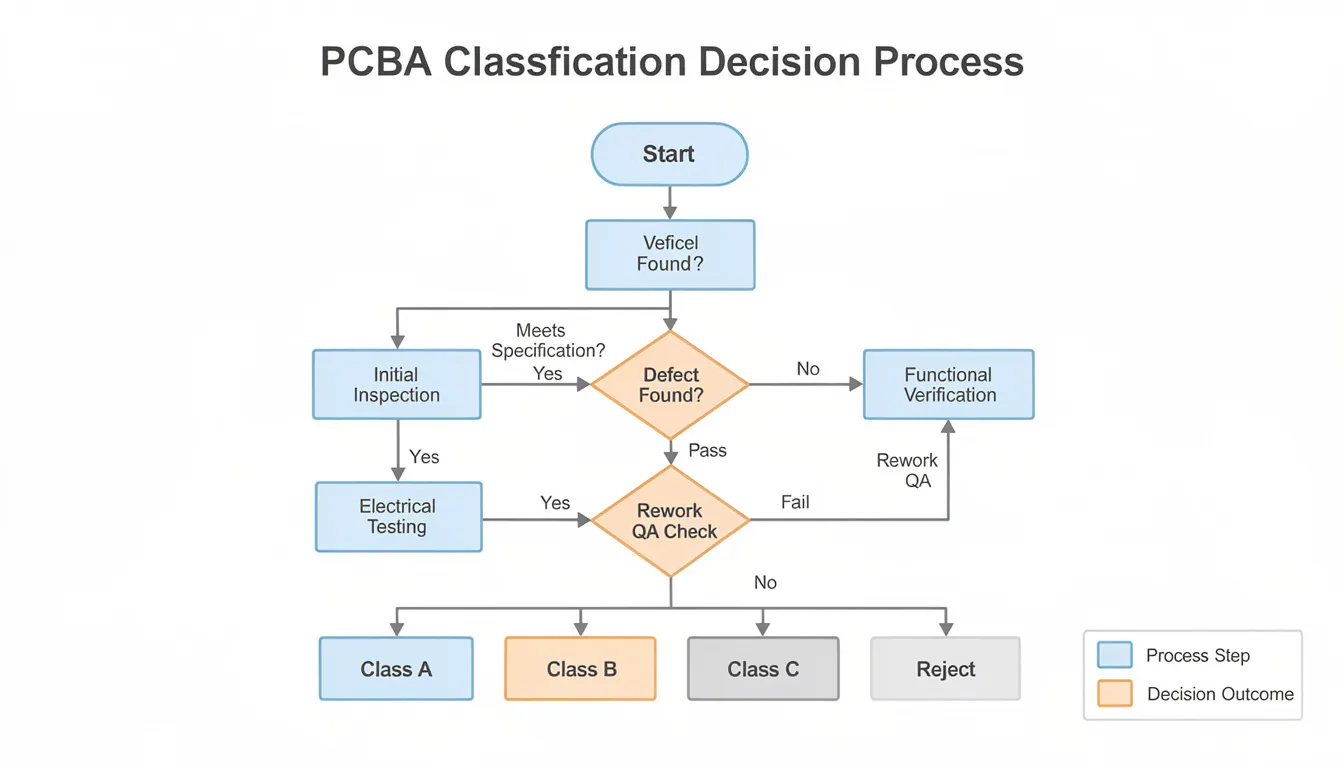

PCBA Classification Process Step-by-Step

Accurate classification begins with comprehensive product analysis that documents both technical specifications and functional characteristics. Create detailed descriptions that include component types, assembly functions, physical dimensions, and integration methods. Correct classification is essential for compliance with export regulations and smooth customs clearance, helping to prevent delays, penalties, and unnecessary costs. This documentation serves as the foundation for classification decisions and supports any future customs examinations or ruling requests.

The classification methodology follows a systematic approach that evaluates multiple factors in sequence. First, determine whether you’re dealing with a bare printed circuit board or a populated assembly, as this fundamental distinction drives initial code selection. Next, analyze the primary components to understand their functional contribution and relative value within the assembly.

Functional analysis requires identifying the assembly’s primary purpose and operational characteristics. Document whether the PCBA processes signals, controls machinery, manages power distribution, or performs measurement functions. This functional assessment directly influences classification decisions, particularly when choosing between general electronic component codes and specific equipment part classifications.

End-use determination involves analyzing how the PCBA integrates into final products and whether it serves dedicated or general-purpose applications. Assemblies designed for specific equipment types often qualify for classification as parts of that equipment, potentially offering more favorable duty treatments than generic electronic component classifications.

Documentation requirements include technical specifications, component lists, functional descriptions, integration diagrams, pcb fabrication processes, manufacturing details, and end-use applications. Maintain detailed records that support your classification rationale, as customs authorities may request this information during examinations or audit procedures.

Component Analysis for Classification

Identifying primary components requires systematic evaluation of all mounted elements, from microprocessors and memory devices to passive components and connectors. Document component functions, values, and manufacturers to support classification decisions and demonstrate the assembly’s primary purpose.

Component value analysis involves calculating the relative cost contribution of different element types within the assembly. Customs authorities often consider whether integrated circuits, discrete components, or the PCB substrate provides the greatest value contribution when making classification decisions.

Mixed-technology assemblies present particular challenges when they combine different component types serving distinct functions. These situations require careful analysis to identify the primary function that drives classification, supported by detailed documentation of component integration and operational characteristics.

Special considerations apply when assemblies incorporate software-defined functionality, wireless communication capabilities, or artificial intelligence processing elements. These advanced features may influence classification decisions, particularly for products that blur traditional boundaries between component categories.

Function and End-Use Determination

Primary function analysis requires identifying the assembly’s core operational purpose from among multiple possible capabilities. Document whether the PCBA primarily processes data, controls mechanical systems, manages electrical distribution, or performs measurement and analysis functions.

End-use application identification involves analyzing the specific equipment or systems where the PCBA operates. Gather documentation about integration methods, communication protocols, and operational dependencies that demonstrate the assembly’s role within larger systems.

Multi-function PCBA classification demands careful evaluation to identify the principal function that should drive classification decisions. Consider operational priorities, value contributions, and market positioning when determining which function represents the primary purpose for customs classification.

Documentation requirements include functional specifications, integration diagrams, operational manuals, and end-user applications. Maintain comprehensive records that clearly demonstrate the assembly’s primary function and intended applications to support classification decisions during customs review processes.

Common Classification Mistakes and Solutions for Correct Classification

One of the most frequent errors involves using bare PCB codes like 8534.00.00 for assembled PCBAs that contain mounted components. This misclassification occurs when importers focus on the physical substrate rather than the functional assembly, leading to incorrect duty calculations and potential customs penalties.

Physical size-based classification represents another common mistake where importers assume that smaller assemblies automatically qualify for integrated circuit classifications. Customs authorities evaluate function and component integration rather than physical dimensions when making classification decisions, making size-based assumptions problematic.

Mixed assemblies containing multiple component types often receive incorrect classification when importers fail to identify the primary function that should drive code selection. These complex assemblies require systematic analysis to determine which functional element provides the principal operational capability for classification purposes.

Generic electronic assembly classifications like 8543.70.9990 are frequently overused for products that qualify for more specific codes based on their intended applications. While these residual classifications provide fallback options, proper analysis often reveals more accurate and potentially more favorable specific classifications.

The solution framework emphasizes systematic documentation and professional consultation for complex classification scenarios. Maintain detailed technical specifications that support classification decisions, and engage customs brokers or trade compliance experts when dealing with high-value or technically complex assemblies.

Real-world examples demonstrate the importance of accurate classification. A recent CBP ruling reclassified analytical instrument PCBAs from generic electronic assembly codes to specific instrument part classifications under 9027.90.5430, highlighting how end-use analysis drives proper classification decisions.

Import and Export Considerations

HTS codes directly affect duty rates for PCBA imports, with rates ranging from zero percent for certain medical device components to over 25% for some consumer electronics assemblies. Understanding these rate variations enables strategic sourcing decisions and accurate cost planning for international procurement operations.

Trade agreements like USMCA provide significant benefits for qualifying electronics components, potentially eliminating duties on PCBAs that meet specific origin requirements. However, claiming these benefits requires accurate classification and documentation that demonstrates compliance with complex rules of origin calculations.

Export control implications affect PCBAs containing dual-use technologies or components subject to International Traffic in Arms Regulations or Export Administration Regulations. Compliance with export regulations is critical for PCBA shipments, especially those containing sensitive or dual-use technologies, to avoid legal penalties and ensure smooth cross-border trade. Certain classifications trigger additional licensing requirements that can significantly impact delivery schedules and customer relationships.

Documentation requirements for smooth customs clearance include commercial invoices with accurate HTS codes, detailed packing lists, certificates of origin for preferential trade programs, and technical specifications that support classification decisions. Incomplete or inaccurate documentation frequently triggers customs holds and examination procedures.

Country-Specific Requirements

United States HTS system utilizes 10-digit codes with specific provisions for electronics assemblies, including detailed statistical suffixes that enable precise classification of PCBA products. The system includes special provisions for certain trade programs and anti-dumping measures that affect specific product categories.

European Union TARIC codes extend beyond basic HS classifications with additional digits that address trade measures, anti-dumping duties, and preferential arrangements. These extended codes require careful verification to ensure compliance with EU-specific trade regulations and duty calculations.

China HS codes incorporate mandatory certification requirements for certain electronics products, including CCC certification for PCBAs intended for specific applications. These requirements add complexity to the import process and may affect product design decisions for Chinese market access.

ASEAN harmonized tariff nomenclature includes regional variations that reflect local trade policies and preferential arrangements among member states. Understanding these variations enables optimization of supply chain routing and duty minimization strategies for Southeast Asian markets.

Role of Customs Brokers

Customs brokers play a vital role in ensuring that businesses dealing with international trade, particularly those involving printed circuit board assemblies (PCBAs), comply with all relevant regulations and laws. Their expertise is crucial in navigating the complex world of Harmonized System (HS) codes, which are standardized numerical classifications used globally to identify products during shipment. By understanding the correct HS code for PCBA, customs brokers can help companies avoid costly delays, penalties, and ensure smooth customs clearance.

One of the primary responsibilities of a customs broker is to assist in the classification of goods, including PCBAs, using the correct HS codes. This involves analyzing the product’s composition, functionality, and intended use to determine the most appropriate code. For instance, a PCBA used in consumer electronics would have a different HS code than one used in industrial equipment. Customs brokers must stay updated on the latest changes to HS codes, as well as any specific codes or regulations implemented by countries involved in the trade.

Customs brokers also facilitate communication between companies and customs authorities, ensuring that all necessary documentation is accurate and complete. This includes commercial invoices, packing lists, and certificates of origin, all of which must include the correct HS code for the PCBA being imported or exported. Their knowledge of international trade regulations, including those related to electronic components and printed circuits, helps businesses comply with existing regulations and avoid potential issues.

Moreover, customs brokers can provide valuable advice on how to minimize duty costs and avoid penalties associated with incorrect HS code usage. They are well-versed in the Harmonized Tariff Schedule (HTS) and can help companies understand the typical HS code structure for PCBAs, which often fall under Chapter 85 of the Harmonized System. By leveraging the expertise of a customs broker, businesses can ensure accurate classification, reduce the risk of customs delays, and maintain compliance with trade agreements and regulations.

In the context of PCBAs, customs brokers must consider the specific characteristics of the product, such as whether it is a bare printed circuit board or an assembled board with integrated circuits and other electronic components. They must also be aware of any trade compliance issues related to the import or export of such products, including restrictions on certain types of electronic assemblies. By working closely with a customs broker, companies involved in the international trade of PCBAs can navigate these complexities with confidence, ensuring that their products reach their destinations efficiently and in compliance with all relevant laws and regulations.

The role of customs brokers in facilitating smooth international trade, particularly for products as complex and varied as PCBAs, cannot be overstated. Their expertise in HS codes, customs regulations, and trade compliance is indispensable for businesses seeking to expand their global reach while minimizing the risks associated with international trade. As the global trade landscape continues to evolve, with changes in trade agreements, regulations, and technologies like automation and AI impacting HS code classification, the importance of customs brokers will only continue to grow.

Classification Tools and Resources

Official databases provide authoritative sources for HTS code verification and research. The USITC HTS database offers comprehensive coverage of United States tariff schedules with detailed classification guidance and rate information. The WCO HS database provides global harmonized system information that supports classification decisions across multiple markets. Consulting official customs references is essential for accurate classification and compliance with customs regulations.

Commercial classification software solutions include comprehensive platforms like SAP GTS, Amber Road, and Descartes that integrate classification capabilities with broader trade management systems. These platforms offer automated classification suggestions, audit trails, and integration with existing ERP systems. Such tools help businesses efficiently find codes for their products, ensuring correct tariff classification for customs clearance and trade efficiency.

Professional services from customs brokers and trade compliance consultants provide specialized expertise for complex classification scenarios. These professionals offer classification analysis, official ruling request preparation, and ongoing compliance monitoring that reduces classification risks for high-volume traders.

Government resources include CBP rulings databases that provide precedential guidance for classification decisions, advance ruling procedures that offer binding classification certainty, and educational materials that explain classification methodologies and requirements. Some countries may have their own codes or proprietary classification systems in addition to the standard HS codes, so it is important to verify requirements for each market.

When to Request Official Classification Rulings

High-value shipments exceeding $100,000 annually justify the time and expense required for official classification rulings, which provide binding certainty that protects against future reclassification risks. These rulings offer legal protection and operational predictability for significant trade volumes.

Novel PCBA technologies without clear classification precedents require official guidance to ensure accurate classification from initial market entry. Emerging technologies like AI-enabled assemblies or quantum computing components may lack existing classification guidance, making official rulings essential for compliance certainty.

Multi-function assemblies with unclear primary purposes benefit from official classification analysis that provides authoritative determination of the correct hs code. These complex products often challenge standard classification methodologies, making professional guidance valuable for compliance assurance.

Products subject to trade restrictions or special duty rates require careful classification analysis to ensure compliance with applicable measures and accurate duty calculations. Official rulings provide certainty about the application of these special provisions to specific product configurations.

Compliance Best Practices for PCBA Traders

Maintaining detailed product specifications and component lists provides the foundation for accurate classification and supports any future customs examinations or audit procedures. Document technical specifications, component sources, assembly procedures, and functional characteristics in formats that facilitate regulatory review.

Regular review procedures for HTS codes ensure continued accuracy as products evolve and regulations change. Establish systematic review schedules that evaluate classification accuracy when products undergo design changes, component substitutions, or market repositioning activities.

Staff training programs develop internal capabilities for accurate classification and reduce dependence on external consultants for routine decisions. Focus training on classification methodologies, documentation requirements, and recognition of scenarios that require professional consultation.

Record-keeping requirements mandate maintaining classification documentation for minimum five-year periods to support potential customs audits and demonstrate compliance efforts. Implement systematic filing procedures that enable rapid retrieval of classification support materials during regulatory examinations.

Staying updated on tariff schedule changes and trade policy developments ensures continued compliance as regulations evolve. Subscribe to official government notifications, participate in trade association activities, and maintain relationships with customs brokers who monitor regulatory developments.

Compliance Best Practices for PCBA Traders

Businesses dealing with international PCBA trade must establish comprehensive classification procedures that ensure accurate codes while minimizing compliance risks. This involves creating systematic documentation processes that capture technical specifications, component details, and functional characteristics needed for proper classification decisions.

Regular classification review procedures help companies maintain accuracy as products evolve and trade regulations change. Establish quarterly reviews of major product lines to verify continued classification accuracy, particularly when design modifications or component substitutions occur during normal product lifecycle management.

Training programs for procurement and logistics staff build internal capabilities for recognizing classification requirements and identifying scenarios requiring professional consultation. Focus training on hs code structure, documentation requirements, and common classification mistakes that affect PCBA products.

Documentation management systems must support rapid retrieval of classification support materials during potential customs audits or examinations. Implement digital filing systems that link HTS codes to technical specifications, component lists, supplier information, and functional descriptions for each product variant.

Monitoring trade policy changes ensures continued compliance as governments adjust tariff schedules, implement new trade measures, or modify preferential arrangements. Subscribe to official customs notifications and participate in trade association activities that provide updates on regulatory developments affecting electronics trade.

Vendor management procedures should require suppliers to provide accurate technical specifications and component information that supports proper classification decisions. Establish contractual requirements for classification-related documentation and verification of supplier-provided HS codes against your own analysis.

Frequently Asked Questions

What’s the difference between HTS code 8534.00.00 and 8542.31.00 for PCBAs?

HTS 8534.00.00 applies only to bare printed circuit boards without any mounted components, covering boards that have printed circuitry but lack active or passive components. HTS 8542.31.00 covers assembled PCBAs with integrated circuits, microprocessors, and other electronic components that provide functional capabilities. The presence of any mounted components typically moves classification from 8534 to other headings based on the assembly’s primary function. Misusing 8534.00.00 for assembled PCBAs represents a common error that leads to customs penalties and potential duty underpayments.

How do I classify a PCBA that serves multiple functions?

Multi-function PCBAs require classification based on their primary or principal function rather than secondary capabilities. Determine which function represents the greatest value contribution, operational importance, or market positioning within the final product application. Document your analysis with component cost breakdowns, functional descriptions, and end-use applications to support the classification decision during customs review. Consider consulting a trade compliance expert for high-value shipments with genuinely ambiguous primary functions, as incorrect classification can result in significant financial penalties.

Can the same PCBA have different HTS codes in different countries?

Yes, the same PCBA can receive different classifications in different countries due to varying national interpretations and additional digits beyond the harmonized 6-digit HS base code. The United States uses 10-digit HTS codes while the European Union employs variable-length TARIC codes that may extend further. Some countries maintain special provisions, local interpretations, or additional requirements that affect classification decisions. Always verify the complete tariff code for each destination country using official tariff databases rather than assuming global consistency in classification approaches.

What are the penalties for incorrect PCBA classification?

Monetary penalties for incorrect classification can range from $1,000 minimum penalties to 20% of shipment value for severe violations, depending on the degree of error and compliance history. Customs delays typically extend 7-14 days for examination and reclassification procedures, affecting delivery schedules and customer relationships. Additional duties and interest charges apply to underpaid amounts, potentially dating back five years for systematic misclassification patterns. Willful misclassification or customs fraud can result in criminal charges, substantial fines, and permanent trade privilege restrictions that severely impact business operations.

How often do HTS codes for PCBAs change?

The core HS nomenclature undergoes major revisions every 5-6 years through the World Customs Organization’s systematic review process, with the most recent update occurring in 2022. Annual updates to duty rates and trade provisions take effect January 1st each year, potentially affecting the financial impact of existing classifications. Emergency changes can occur throughout the year due to trade disputes, new technology developments, or national security considerations that require immediate classification adjustments. Companies should subscribe to CBP updates, monitor WCO announcements, and maintain relationships with customs brokers who track classification changes affecting electronics trade to ensure continued compliance with evolving regulations.